Sahisnu Malapati: Investment Banking Analyst -> Corporate Development Associate

Hear from Sahisnu on how he recruited for banking and, then ultimately, why he decided to transition to a start-up

Clew is on a mission to make recruiting and career mentorship in hyper competitive industries more transparent and accessible. We do this by sharing actionable recruiting and career advice from 1:1 interviews with professionals who have direct experience and exposure.

Sahisnu Malapati

New York University

Sahisnu is a former J.P. Morgan Investment Banker who now works on the corporate development team of Next Insurance – an online insurance start-up for small businesses

For those in college:

On approach to building his profile:

I approach building my profile as a reflection of my short-term (3 months – 2 years) and long-term goals (5+ years).

My short-term goals are building blocks to reach my long-term goal and therefore, could change based on what I hear in classes, clubs, mentors, and networking.

As I went through college and even now in the professional world, I find that my long-term goals changing slightly year over year allows them to become more defined.

It's important to be cognizant of your profile, especially in the professional world - this method of framing it around my goals helps me keep it top of mind

On networking:

I think there is always a benefit to networking; while in the beginning it may feel like more of a “means to an end” in regards to getting a job opportunity, networking is a skill that everyone should develop even just to remain knowledgeable in an increasingly cross-functional world.

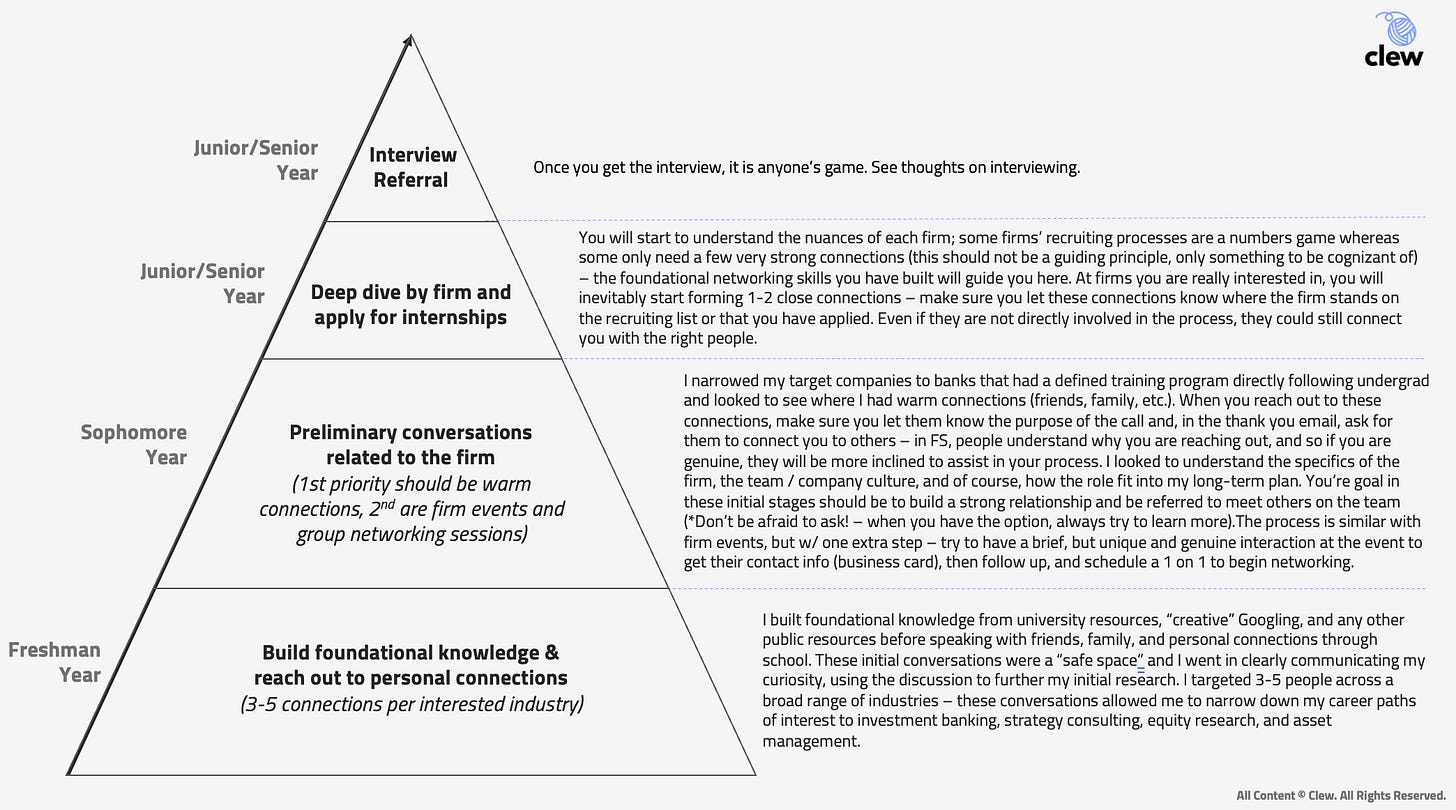

In college, I approached professional networking based on the following:

On choosing an internship or full-time position:

I always thought about platform versus exposure. It is a balance between these two things.

Think of the platform as the firm itself – it’s reputation, resources, and investment in you. These are the kind of items you take for granted that come with the promise of an opportunity at this firm.

Exposure is the responsibility that you will be given. This can be influenced by the depth of connections that you have at the firm, the work and mentorship that you will be exposed to, and the team you are working with. You can think of these as more unique opportunities or differentiators that will aid in achieving your longer-term goals. Of course, exposure can be the product of a very strong platform, but I would urge you to think of it more as a product of the specific role you are pursuing at the firm, rather than the institution itself (not a perfect system, but it gives you a working framework).

For me, after a certain level, exposure mattered more when evaluating a company against my long-term goals.

On choosing banking:

I chose banking because it was:

Quantitatively Strategic and put the technical skills (corporate finance, marketing, etc.) I learned in college to use

Cross-functional and allowed me to be exposed to different types of companies and management teams early on in my career

I was fortunate enough to go to a pre-professional undergraduate business school in NYC that allowed me to be exposed to banking, consulting, and data analytics careers since Day 1.

Consulting, specifically strategy consulting, was a close second.

On interviewing:

From a technical perspective, ‘Breaking into Wall Street’ + networking gave me all the information I needed.

My final interviews with J.P. Morgan never involved any traditional “banking technicals.” I still put time in to learn them, but through explaining my motivation to join the firm, discussing current events, and industries I was interested in, it became clear that I was technically competent. Generally, more preliminary interview rounds include technical assessments as “check in the box”. This varies by firm though.

When doing mock interviews, I made sure to do interviews with people who had been on the other side or currently working at the firm, specifically people at the firm who I had a good relationship with and could ask about the types of questions they were asked.

It is important to think about the strengths of the mock interviewer and get a variety of interviews; some interviewers are technically sound and can give you better advice in that field whereas some are behaviorally stronger.

For young professionals:

On succeeding as an analyst:

Top analysts rarely differentiate themselves on technical skills – this is table stakes. Top analysts are differentiated by the ability to prioritize asks and understand what needs to be done within the project apart from the tactical asks.

I always found that trying to make my direct manager’s job as easy as possible was a helpful way to think about my approach.

It is important to take a step back and see how your work fits into the larger picture – try not to be just a process machine

On networking full-time:

The work product speaks for itself – you have to be good at your job.

I try to develop a good working relationship that is more than just getting coffee. While working on a live deal may not always be feasible, working with the other person in some capacity – an adhoc project, recruiting event, +1 - is a much stronger and natural connection than just coffee.

On switching from banking to a start-up:

I thought about my manager and the senior leadership he reported to and asked myself ‘Am I interested in the work they are doing?’ This was a yes for me.

I then asked myself, ‘Are there other areas of opportunity, both in my career and outside of work, that may not be there if I stay on this path? In other words, while I find my senior leadership’s work interesting, do I want to follow the same path? If not, perhaps there are other options to pursue. This was an area where my seniors and I valued different things and is especially important in an apprenticeship model.

In the long-term, I knew that if I wasn’t going to stay in banking then I wanted a role where I would have an impact on the entire operations of the company and work with teams that had a very different skillset than mine (e.g. data analysts, PM’s, FP&A, etc.)

As my long-term goal started to shift towards a more corporate leadership role, I realized I would need to start building different skills on top of those I gained as banker. Also, I began to see other opportunities in the short term that were more interesting and able to offer greater exposure towards my goals.

On interviewing and negotiations:

I felt that interviewing after graduation was easier since the roles I was looking at were directly in line with my knowledge and interests. Prep consisted of brushing up on behaviorals, walking through past projects/deals, and A LOT of reading on the company, industry and role + responsibilities.

I also made sure to talk with peers in the industry or, if I could, employees at the company about the responsibilities, expectations, and general experiences of the roles I was interviewing for.

I learned that there is definitely more room for negotiations in my second job out of college.

I spoke with people who were in similar roles, Googling, and headhunting firms to get a better sense of the market rate and pay range.

Thank you!

Thank you for reading our first issue. If you would like similar content delivered straight to your inbox 2x a month, please subscribe below.

If you know someone recruiting or navigating a career in business or technology, please share Clew with them.

Questions, feedback, or interview referrals? Reply to this email.